Since the Indian Ocean tsunami of December 26, 2004, the landing platform dock (LPD) and the amphibious assault ship (LPH) have emerged as an instrument of soft power, with their on-board fleets of multi-purpose utility helicopters, landing craft, and air-cushion vehicles; plus their command-and-control capabilities and cavernous holds proving to be invaluable for disaster relief, small-scale policing or mass civilian evacuation operations. At the same time, the LPDs and LPHs have today emerged as invaluable tools for undertaking asymmetric warfare (against pirates in the high seas), expeditionary amphibious campaigns (such as those undertaken by the Royal Navy in 1982 to retake the Falklands Islands), and low-intensity maritime operations involving vertical envelopment tactics, which the Indian Navy (IN) calls “effecting maritime manoeuvres from the sea”.

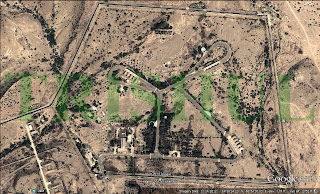

It was in the September 2004 that I had penned an analysis on the need for the IN to urgently begin planning for acquiring a modest fleet of no less than three LPHs for it to undertake both humanitarian relief operations within the Indian Ocean Region (IOR) whenever required, as well as prepare for the prospects of undertaking power projection-based expeditionary amphibious campaigns with its own integral naval infantry assets (as opposed to the still existing flawed practice of transporting a mere mechanised battalion of the Indian Army (IA) on board large landing ship tanks (LST-L). It, therefore, came as no surprise almost four months later when Navy HQ, headed at that time by Admiral Arun Prakash, the Chief of the Naval Staff, directed the Directorate of Plans & Operations to begin preparing the NSQRs for procuring a fleet of LPHs with a great sense of urgency. However, matters did not move swiftly enough on the procurement front, despite the articulation and unveiling by Navy HQ of its doctrines for effecting maritime manoeuvres from the sea though joint amphibious warfare operations. This, however, did not deter the Navy from setting up—on June 24, 2008—its Advanced Amphibious Warfare School and Fleet Support Complex--in the enclave that will come up along the beach road on the outskirts of Kakinada, about 500km from Hyderabad, in the state of Andhra Pradesh. It is here that the Navy is quietly but progressively raising its first of three naval infantry battalions (to eventually become a Brigade-strength formation), which will be trained and equipped to undertake both amphibious and vertical envelopment air-assault operations.

On the procurement front, matters began to move only in October 2010 when the Cabinet Committee on National Security accorded approval to Navy HQ to begin drafting the Request for Information (RFI) regarding the acquisition of four LPHs and related hardware under the ‘Buy and Make Indian’ clause of the Defence Procurement Policy (DPP-9). Under this clause, the Ministry of Defence (MoD) can invite proposals (based on a capability definition document) from those Indian shipbuilders from both the public sector and private sector that have the requisite financial and technical capabilities to enter into joint ventures with foreign shipbuilders and together undertake indigenous construction of the warships. In early December 2010, the Navy HQ issued its RFIs to Pipavav Defence & Offshore Engineering Company Ltd, Cochin Shipyard Ltd, Mazagon Docks Ltd, Garden Reach Shipbuilders & Engineers Ltd (GRSE), Larsen & Toubro Ltd, and the Vizag-based Hindustan Shipyard Ltd (HSL). These shipyards were required to forward a Detailed Project Proposal outlining the roadmap for the development of design and construction of the LPDs. After the RFI responses were submitted by March 7, 2011 the Detailed Project Proposal, thereafter, was examined by a Project Appraisal Committee (PAC) constituted by the MoD’s Acquisition Wing to verify the credentials of the foreign partners, together with confirming the acceptability of the respective joint ventures between the Indian shipyard and its foreign collaborator. By September 2011, the Indian shipyards shortlisted for issue of the RFPs were intimated. The Request for Proposals (RFP), however, was issued earlier this month.

Foreign shipbuilders offering LPH solutions include DCNS of France with its Mistral-BPC 21,300-tonne LPH, Germany’s ThyssenKrupp Marine Systems with its 20,000-tonne MHD-200 LPH (with two separate heli-decks on two levels), Fincantieri of Italy with its 20,000-tonne Mosaic LPH design, South Korea’s Hanjin Heavy Industries & Constructions Co with its 18,800-tonne Dokdo-class LPH, and Navantia of Spain with its Athlas 21,560-tonne LHD. The favourite contenders are expected to be Navantia and Ficantieri.

A separate RFP will be issued in future for licence-building high-speed air-cushioned vehicles from either US-based Textron Marine and Land Systems (LCAC) or Hanjin Heavy Industries & Constructions Co (LSF-2), LCMs (with designs being offered by Navantia and Hanjin Heavy Industries & Constructions Co), or high-speed catamarans, for which France’s CNIM is likely to offer its L-CAT catamaran.

A detailed analysis of the RFP for the LPH requirement brings out several interesting indicators about both the overall configuration of the desired vessel and its performance/operational capabilities. For instance, the RFP has specified that the length of the vessel should be 213 metres; the draught should not exceed 8 metres; the endurance at sea must be for 45 days; the propulsion system of should be of the integrated full-electric propulsion (IFEP) type; the vessel must have a suitable well-deck for carrying amphibious craft like LCMs or LCACs and LCVPs on davits and should have the capability to launch these craft when underway; the vessel must be able to house combat vehicles (including main battle tanks, infantry combat vehicles and heavy trucks on one or more vehicle deck; and the vessel should be able to undertake all-weather operations involving heavylift helicopters of up to 35 tonnes MTOW. Weapon systems and mission sensors to go on board the projected four vessels will all be pre-selected (known also as customer-furnished or buyer-nominated equipment). Such hardware will include the point-defence missile system (PDMS), close-in weapon system (CIWS), anti-torpedo decoy system, countermeasures dispensing system and 20mmmm heavy machine guns. In addition, each of the four vessels will be required to have one E/F-band combined air-surface surveillance radar, one C/D band air surveillance radar, and an integrated marine navigation system employing X- and S-band navigation radars.

The IN has finally zeroed in on integrated full-electric propulsion (IFEP) systems, starting with the four projected LPHs to be procured (one directly from a yet-to-be-selected foreign OEM, and three to be licence-built by a MoD-owned shipyard in cooperation with a private-sector shipyard). Present-day warships worldwide utilise a combined-diesel-and-diesel (CODAD), combined-diesel-and-gas (CODAG), combined-gas-and-gas (COGAG) or combined-diesel-Electric-and-gas (CODLAG) propulsion configurations. At cruising speeds a CODLAG system employs diesel generators to supply electricity to the electric motors that drive the propeller shafts. When high speeds are required, gas turbines engage the shafts via cross-connecting mechanical transmissions (gearboxes). In an IFEP system-equipped warship, on the other hand, there is no mechanical connection between the prime mover and shaft. Instead, both the gas turbines and diesels are configured as electricity generators. While the diesels provide the vessel’s base load electrical supply, including low-speed propulsion, the turbines are switched in for peak power. The benefits of IFEP include: flexibility in locating machinery (only the propulsion motor needs to be coupled mechanically to the shaft-line); fuel efficiency (when the warship is operated at part load); low noise and vibration; built-in redundancy (electrical machines may have more than one set of windings, fed from different sources, so power is still available if one set fails); reliability (a mean-time-between-failures of more than 100,000 hours); reduced maintenance costs (due, for instance, to the absence of gearboxes); and the scope for increased automation and reduced crew complement.

The IN’s LPHs will also employ fixed-pitch propellers. Controllable-pitch propellers and their associated complex hydraulics are not required since the motor, and thus the shaft, can be electrically reversed. However, the IN is against the procurement of podded propulsion systems—a point that could well go against the Mistral BPD-class LPH that DCNS of France is offering for the IN. It is thus widely expected that the IN will zero in on an IFEP system developed by UK-based but GE-led Converteam industrial consortium.

Coming now to the weapons suite, the IN has a choice of combinations to choose from, including the SeaRAM and Phalanx Block 1B from Raytheon, Sadral from MBDA integrated with OTOBreda of Italy’s twin-barrel 30mm/82 Compact or the Goalkeeper from THALES Nederland, the combination of Phalanx Block 1B and Barak-1 from Israel Aerospace Industries, and the combined Palma PDMS/CIWS from Russia’s Tulamashzavod JSC. It is believed that the Phalanx Block 1B/Barak-1 combination is the Navy’s preferred choice. The Navy’s shipboard decoy control and launching system of choice is the Kavach, which has been developed by the DRDO and is being built by Mahindra Defence. The combat management system and ELINT/EW suites will be procured off-the-shelf as standard fitment along with the LPHs.

Helicopters For LPHs

Initially, when the IN was in the process of drafting the RFP for the four LPHs, it also wanted to draft a separate RFP for procuring 44 heavylift utility helicopters as well. This, however, was opposed by the Indian Air Force (IAF), which then insisted on having a decisive say on finalising the QRs for such helicopters, since it is believed that the IAF wanted to be the one undertaking the vertical envelopment/replenishment roles. As matters now stand, it is most unlikely that the IAF will be allowed to take over such roles because A) the IAF does not possess any heavylift helicopter configured for shipborne operations. B) none of its Mi-17V-5s are equipped with emergency flotation systems (which is mandatory when flying over water). C) the IN and IAF have totally divergent air traffic management (ATM) protocols, and since it will be the IN that will be the sole provider of ATM services for the tactical airspace below which amphibious assault operations will be undertaken by the Sagar Prahari Bal (whose sanctioned strength is 15,000-strong), logic demands that the IN raise its own dedicated fleet of shipborne heavylift helicopters as well. If the IN’s views prevail, then the potential contenders could include the AgustaWestland AW-101, and Sikorsky’s S-92 Super Hawk or CH-53K Super Stallion.

Fleet Replenishment Tankers

For supplying the IN with five fleet replenishment tankers, RFPs have been issued to Indian shipbuilders only, who are now scouting for suitable designs from foreign shipbuilders. These five vessels will supplement the INS’s two relatively new fleet replenishment tankers—INS Deepak (A50) and INS Shakti (A57)—built by Fincantieri of Italy in a record period of two years as per the terms of the 139 million Euros contract signed between the Ministry of Defence (MoD) and Fincantieri in October 2008. Built at Fincantieri’s Yard 6186 at Muggiano, the first double-hulled tanker was launched on February 12, 2010 and was commissioned into service on January 21, 2011. The second tanker—INS Shakti—was commissioned on October 1, 2011. As part of the direct industrial offsets package for the first fleet tanker, Fincantieri had in 2008 placed an order worth 14.3 million Euros with Bharat Electronics Ltd for the supply of a composite communications system, versatile communications suite, ESM system, and an optronic fire-control system.

Each of the two tankers is 175 metres long, 25 metres wide and 19 feet high, and has a displacement at full load of 27,500 tonnes. Each of them are powered by two 10,000kW diesel engines that drive the twin adjustable-pitch propellers. The tanker can reach a maximum speed of 20 Knots, can refuel four warships at the same time, has a hangar to accommodate a 10-tonne helicopter, and can provide accommodation for 250 personnel, including its crew complement. The tankers’ construction programme at Muggiano involved three different shipyards of Fincantieri, using state-of-the-art ship construction methods and concepts with extensive parallelism and concurrent engineering to deliver them in a challenging timeframe of two years. The double-hull configuration provides greater safety against accidental oil spillages in accordance with latest MARPOL regulations.

However, the acquisition of these two tankers had its share of controversy, when the Comptroller and Auditor General (CAG) of India criticized the acceptance of inferior-grade steel used in the manufacture of the two fleet tankers, saying that it amounted to according “undue favour to a foreign vendor in the procurement of fleet tankers”. The CAG also saw a problem with the excess provisioning of spares worth more than Rs300 million (US$6 million) and under-realisation of industrial offsets benefits to Indian industry’ under the Rs9.36 billion ($200 million) contract. The CAG’s report revealed that the original RFP had a mandatory stipulation requiring the use of ‘DMR-249A or equivalent grade steel’ in the construction of the two fleet tankers, which it said is almost double the cost of ordinary steel. The report added that in order to maintain its approved force levels, the IN’s Shipbuilding Plan had envisaged the addition of two fleet tankers by 2008 and 2011, respectively. Accordingly, a RFP was issued to 12 firms in November 2005. In response to the RFP, only three firms responded—Russia’s Rosoboronexport State Corp, South Korea’s Hyundai Heavy Industries Ltd (HHIL), and Fincantieri. Out of them, only Rosoboronexport offered a technical proposal for using DMR-249A or equivalent steel. HHIL’s proposal was rejected due to non-compliance with the RFP’s provisions, which included non-usage of DMR-249A steel. Fincantieri’s proposal was stated to be compliant with the RFP conditions. However, the firm proposed usage of DH-36 steel instead of DMR-249A. The justification offered by Fincantieri for selection of DH-36 to the MoD’s Technical Evaluation Committee (TEC) included problems in sourcing DMR-249A steel, the normal use of ordinary steel for tankers and an explanation on why the high-resilience performance of DMR-249A was not necessary for the tankers. This was despite Fincantieri’s own admission that DH-36 has less weight and less resilience when compared to DMR-249A, and the chemical compositions of DH-36 grade steel and DMR-249A steel being different and therefore they cannot be treated as equivalent to each other. The prices of these two grades of steel are also different, since DMR-249A is more expensive than DH-36 grade steel. “Nonetheless,” said the CAG, “the TEC opined that DH-36 was equivalent to DMR-249A and accepted Fincantieri’s technical bid without taking due cognizance of the competing offers made by Rosoboronexport and HHIL. The Technical Oversight Committee too ruled in favour of Fincantieri after the commercial bids were opened, since Fincantieri emerged as the lowest bidder with a quote of Rs7.23 billion. The offer of Rosoboronexport was rejected as it was costlier, being based upon the prices of DMR-249A or equivalent steel”.

Resolving The CM-400AKG Supersonic ASM Conundrum

Resolving The CM-400AKG Supersonic ASM Conundrum

Let us begin with what is available to the Pakistan Air Force (PAF) and Pakistan Navy (PN) in terms of maritime strike capabilities. The PAF’s No8 ‘Haiders’ Squadron operating out of Karachi’s Masroor Air Base presently operates only two Dassault Aviation-built Mirage-VPA3s, each of which can be armed with two MBDA-built 55km-range subsonic AM-39 Exocet ASCMs. They will be replaced in the near future by six JF-17 Thunder MRCAs, each of which will be able to carry two IIR-guided CM-802AKG subsonic anti-ship cruise missiles (ASCM) plus one data-link pod for man-in-the-loop guidance (a configuration identical to what the PLA Navy has adopted for its JH-7A maritime strike aircraft and which is similar to the RAFAEL-built Popeye PGM/Pegasus data-link pod combination).

The CM-802AKG, 40 of which have been ordered by the PAF, has a range of 230km, weighs 670kg, and comes with a blast-penetration warhead weighing 285kg.

The PN, on the other hand, has at its disposal 120 C-602 ASCMs of which along with 40 8 x 8 transporter-erector-launcher vehicles, three Agosta 90B and two Agosta 70B SSKs that can be armed with subsonic Boeing UGM-84A Harpoon ASCMs, plus six Lockheed Martin P-3C Orion LRMR/ASW aircraft armed with subsonic AGM-84A Harpoon ASCMs, along with several ship-launched subsonic AGM-84A Harpoons and 180km-range subsonic C-802A ASCMs.

The C-602 is a conventional cruise missile design, with mid-body wings that deploy following launch. The fixed ventral air inlet is mounted slightly forward of the cruciform tail fins. The missile is 6.1 metres long (without the 0.9 metre-long launch booster), and weighs 1,140kg. The solid propellant booster weighs an additional 210kg.

The C-602 has a cruise speed of Mach 0.6, carries a 300kg HE blast-fragmentation warhead, is powered by a small turbojet, and has a stated range of 280km, with the missile flying at an altitude of 30 metres during the cruise phase of an engagement. In the terminal phase, the missile descends to a height of seven metres, and it can be launched from truck-mounted launchers, from warships as well as from medium multi-role combat aircraft.

The C-602 is a conventional cruise missile design, with mid-body wings that deploy following launch. The fixed ventral air inlet is mounted slightly forward of the cruciform tail fins. The missile is 6.1 metres long (without the 0.9 metre-long launch booster), and weighs 1,140kg. The solid propellant booster weighs an additional 210kg.

The C-602 has a cruise speed of Mach 0.6, carries a 300kg HE blast-fragmentation warhead, is powered by a small turbojet, and has a stated range of 280km, with the missile flying at an altitude of 30 metres during the cruise phase of an engagement. In the terminal phase, the missile descends to a height of seven metres, and it can be launched from truck-mounted launchers, from warships as well as from medium multi-role combat aircraft.

It is evident that when both the PAF and PN are already in possession of formidable sea denial capabilities, it makes little sense to go for a supersonic ASM that is claimed by its Chinese OEM to have an IIR terminal seeker. Incidentally, all existing operational supersonic ASCMs to date, like the 130km-range, Mach 2.3, 1.5-tonne, 225kg self-forging fragment warhead-armed Hsiung Feng-3/Brave Wind-3 of Taiwan; Russia’s 4.15-tonne, Mach 3, 120km-range Raduga Kh-41 Zubr armed with 320kg HE warhead; Russia’s Novator 3M54E Klub-S/N, India’s BrahMos-1; and Japan’s 200km-range, Mach 2+ Mitsubishi ASM-3, all make use of on-board active radar seekers for terminal guidance, simply because no supersonic ASCM-based IIR sensor has the kind of target detection/lock-on range of up to 26km.

The 910kg/2,000lb CM-400AKG, possessing a claimed engagement envelope of 240km (130nm) a maximum cruise speed of Mach 4, airframe diameter of 0.4 metres, and 200kg blast-penetration warhead, has apparently been designed to be launched when the JF-17 reaches cruise speeds of between 750kph and 800kph at altitudes of between 26,200 feet and 39,400 feet. While its on-board RLG-INS offers a CEP of 50 metres (164 feet) during the mid-course navigation phase, the CEP reportedly gets reduced to 5 metres when the IIR seeker is activated during the terminal guidance phase.

If it is imperative that the JF-17 attain an altitude of either 26,200 feet or 39,400 feet in order to launch its two CM-400AKGs in ripple-fire mode, the element of surprise will be lost very early since the missile is not sea-skimming and will be detected by warship-mounted active phased-array volume search radars like the EL/M-2248 MF-STAR, while the airborne JF-17 will be easily located and tracked by AEW platforms like the Ka-31 AEW helicopters while the JF-17s are still 250km away from the IN’s targetted carrier battle group. And lastly, the JF-17 will have to continue cruising at medium altitudes so that the underbelly data-link pod can continue to maintain line-of-sight contact with the CM-400AKG’s (and even that of the CM-802AKG) on-board IIR imagery transmitter. Incidentally, neither during the Airshow China 2012 in Zhuhai last November nor during the recently concluded Dubai 2013 Airshow was any data-link pod displayed by Chinese OEMs like CETC International.

Countering The ASCM Threats

The IN today is sufficiently well-protected against subsonic ASCMs, thanks to the combination of indigenously developed shipborne jammers and RAFAEL-built Barak-1 CIWS, which will in future be supplemented by the EL/M-2248 MF-STAR/Barak-2 LR-SAM combination, along with IAI/ELTA Systems-supplied EL/M-2222S NAVGUARD, which is an active phased-array radar-based missile approach warning system (MAWS) that automatically detects, classifies and verifies incoming threats, and consequently triggers the targetted warship’s hard-kill/soft-kill self-defence systems.

The IN today is sufficiently well-protected against subsonic ASCMs, thanks to the combination of indigenously developed shipborne jammers and RAFAEL-built Barak-1 CIWS, which will in future be supplemented by the EL/M-2248 MF-STAR/Barak-2 LR-SAM combination, along with IAI/ELTA Systems-supplied EL/M-2222S NAVGUARD, which is an active phased-array radar-based missile approach warning system (MAWS) that automatically detects, classifies and verifies incoming threats, and consequently triggers the targetted warship’s hard-kill/soft-kill self-defence systems.

How China’s CH-3 UCAV Has Become Pakistan’s Burraq UCAV

On November 25, 2013, Pakistan’s ISPR announced that the Pakistan Army and PAF had inducted the first batch of ‘indigenously developed’ strategic UAVs, namely the Burraq and Shahpar UAV Systems, into the Pakistan Army and PAF. It was claimed that the Burraq has been developed by Pakistan's state-owned NESCOM.

However, a closer examination of the photo of the Burraq released by the ISPR clearly proves the fact that it is merely a NESCOM-assembled CH-3, which has been developed by China Aerospace Science and Technology Corp (CASC) and AVIC Defense as amulti-purpose medium-range UAV system suitable for battlefield reconnaissance, artillery fire adjustment, data relay and electronic warfare. The CH-3 can be armed with twin laser-guided AR-1 anti-armour missiles, has a cruising speed of 220kph, 12-hour maximum endurance, and a 200km line-of-sight communications radius.

How Will The IN Face-Off Against The PN In Future

How Will The IN Face-Off Against The PN In Future

It is fairly evident now that while on one hand the IN—with its Project 1241RE FAC-Ms armed with P-20 ASCMs, Project 1241REM FAC-Ms armed with Uran-E ASCMs and Project 25/25A corvettes armed with P-20/Uran-E ASCMs—will not be able to replicate the kind of successes in scored on its western seaboard on December 4, 1971 with its Project 205 FAC-Ms firing P-15 ASCMs, the PN too will not be able to replicate what it had achieved on September 6, 1965. And it can also be inferred that in the event of future conventional hostilities between India and Pakistan, the three armed services of both countries will fight their own set-piece battles as per their individual war-plans, and not according to a single operational war-plan aimed at the attainment of strategic objectives through synergistic and synchronised warfighting efforts. Furthermore, it has been the case since mid-1998 that future wars in the subcontinent under a nuclear overhang will be of the limited, high-intensity-type and not all-out conventional wars. Consequently, in the event of the Indian Army’s (IA) HQ Northern Command adopting a pro-active warfighting posture and deciding to launch a limited, pre-emptive ground offensive across the LoC, the IAF’s Western Command can be expected to help the IA increase its operational tempo by lending close air support and achieving tactical air superiority, but the IN will be forced to remain a mute, non-participating spectator since 1) it will lack the wherewithal and tools (like long-range warship-launched/submarine-launched/air-launched long-range cruise missiles) required for making meaningful contributions to the land battle; and 2) India’ apex-level civilian decision-makers—being risk-averse by nature—will not be in favour of vertical military escalation. Thus, the IN will be unable to put into motion its much-touted ‘effecting maritime manouvres from the sea’ warfighting plans.

The IN’s inability to gain sea control and battlespace superiority during the first 72 hours of an all-out conventional war between India and Pakistan was convincingly demonstrated during a wargame (shown in the slide above) that was played out in Delhi in 1986 when EX Brass Tacks was in full-swing. At that time, it was convincingly demonstrated that the PN and PAF of that time could easily create and sustain a ‘cordone sanitaire’ measuring 266km in depth, which in turn could easily neutralise any kind of threat posed by an IN carrier battle group.

Matters did not improve at all by mid-1999 when OP Vijay and OP Safed Sagar were launched. At that time, while the IN’s sole aircraft carrier, INS Viraat, was undergoing one of her periodic refits (thereby denying the IN’s combined Western and Eastern Fleets the element of battlespace air superiority), the Cabinet Committee on National Security (CCNS) did not issue an operational directive to the IN simply because India had then not formally declared that she was in a state of war with Pakistan and therefore, both OP Vijay and OP Safed Sagar were both classified at best as an Air-Land counter-insurgency campaign, not even limited war. Consequently, the IN at best only mobilised itself in a limited manner and under OP Talwar, deployed out to the northwest portion of the Arabian Sea for the purpose of conducting missile-firing drills (see slide above). Thus, bravado aside, the IN was denied the chance to demonstrate its sea-control and sea-denial capabilities. This state of affairs was again repeated in 2002 during OP Parakram.

Coming now to present-day matters, the IN’s war-planners are faced with 1) the PN’s formidable, multi-tier sea-denial capabilities (already explained above) throughout Pakistan’s coastline; and 2) the steady growth of the PN’s elite undersea warfare arm, now comprising three MESMA AIP module-equipped Agosta 90B SSKs and to be joined in future by two upgraded Agosta 70B SSKs and up to six Type 032 Qing-class SSKs equipped with Stirling Engine-type AIP modules.

As the slide below illustrates, any CBG of the IN will be extremely hard-pressed to launch any kind of credible, sustained expeditionary power projection campaign against the PN. The only viable offensive option for the IN remains its fleet of eight Type 877EKM SSKs (each of which will in future be able to launch four Novator-built 3M-14E Klub-S LACMs while staying submerged 100nm away from Karachi), if one assumes that the PN’s principal surface combatants and FAC-Ms will be bottled-up within their respective homeports during a future round of hostilities since they will be targetted for sure by the IN’s AGM-84L Harpoon ASCM-armed P-8Is as well as by the IAF’s Jamnagar AFS-based 10 Jaguar IMs (armed with AGM-84L Harpoon ASCMs) and six MiG-29UPGs armed with Kh-35UE ASCMs.

As the slide below illustrates, any CBG of the IN will be extremely hard-pressed to launch any kind of credible, sustained expeditionary power projection campaign against the PN. The only viable offensive option for the IN remains its fleet of eight Type 877EKM SSKs (each of which will in future be able to launch four Novator-built 3M-14E Klub-S LACMs while staying submerged 100nm away from Karachi), if one assumes that the PN’s principal surface combatants and FAC-Ms will be bottled-up within their respective homeports during a future round of hostilities since they will be targetted for sure by the IN’s AGM-84L Harpoon ASCM-armed P-8Is as well as by the IAF’s Jamnagar AFS-based 10 Jaguar IMs (armed with AGM-84L Harpoon ASCMs) and six MiG-29UPGs armed with Kh-35UE ASCMs.

If at all the IN wants to wage credible, offensive AirLand campaigns, then there are only three available options that need to be exercised:

Firstly, while it is agreed that a big aircraft carrier is vulnerable and its steep construction and operating costs are good reason for possessing an aircraft carrier fleet with smaller vessels like INS Vikramaditya and Project 71/IAC-1/INS Vikrant, the problem one will discover later is that such aircraft carriers, even if fractionally smaller then the big flattop, cause the effectiveness of their air-wings to rapidly decease, while their vulnerability to mission-kill or loss exponentially increases, and their lifetime maintenance cost (primarily due to their dependence on fossil fuels) becomes much higher over 30+ years than that of a 65,000-tonne big-deck nuclear-powered aircraft carrier. Moreover, while being vulnerable to attack, the big-deck nuclear-powered aircraft carrier is still arguably one of the toughest warships to sink. Furthermore, if it takes 4 tonnes of LGBs to accomplish a strike mission regardless of inclement weather conditions, then the IN will be required to deploy against such a target at least three MiG-29Ks armed with LGBs and LDPs, plus another two MiG-29Ks for tactical offensive air superiority and at least four MiG-29Ks configured as aerial refuelling tankers.

Sustaining such daily air taskings for a 7-day period (assuming three such strike sorties are launched daily) easily translates into a requirement for at least 60 MiG-29Ks. Incidentally, initial operational training for the five pilots who would each fly a MiG-29K for 1,700 hours during the life of the aircraft conservatively cost US$2 million. Fuel, spare parts and maintenance cost $60 million over the life of the MiG-29K, leading to an estimated total life-cycle cost of $120 million each. On average, a MiG-29K squadron has to annually fly some 500 hours, or about 32.5 hours per pilot, to maintain warfare readiness, and that is just during the 12-month home-cycle. Once deployed at sea, squadron flight-hours will increase to approximately 650 per month, or 38 per pilot. One-third of these hours are expended for maintaining the currency and qualifications of the pilot. In the end, over the full extent of its airframe TTSL, the average MiG-29K will log just 20% of its mandated flight-hours in combat. Much of this time will involve transiting to and from the operating area, with 30 minutes per flight, at most, being dedicated to the operational mission. The effectiveness of such missions can best be measured in ordnance expended. For instance, to achieve the same returns on investment as a long-range Nirbhay-type LACM (costing no more than $3.5 million), a MiG-29K will need to fly nearly four times the number of sorties.

Sustaining such daily air taskings for a 7-day period (assuming three such strike sorties are launched daily) easily translates into a requirement for at least 60 MiG-29Ks. Incidentally, initial operational training for the five pilots who would each fly a MiG-29K for 1,700 hours during the life of the aircraft conservatively cost US$2 million. Fuel, spare parts and maintenance cost $60 million over the life of the MiG-29K, leading to an estimated total life-cycle cost of $120 million each. On average, a MiG-29K squadron has to annually fly some 500 hours, or about 32.5 hours per pilot, to maintain warfare readiness, and that is just during the 12-month home-cycle. Once deployed at sea, squadron flight-hours will increase to approximately 650 per month, or 38 per pilot. One-third of these hours are expended for maintaining the currency and qualifications of the pilot. In the end, over the full extent of its airframe TTSL, the average MiG-29K will log just 20% of its mandated flight-hours in combat. Much of this time will involve transiting to and from the operating area, with 30 minutes per flight, at most, being dedicated to the operational mission. The effectiveness of such missions can best be measured in ordnance expended. For instance, to achieve the same returns on investment as a long-range Nirbhay-type LACM (costing no more than $3.5 million), a MiG-29K will need to fly nearly four times the number of sorties.

Which then brings us to the second option: invest big-time on long-range warship-launched, air-launched and submarine-launched LACMs. While an air-launched BrahMos-1/A ASCM makes sense for land-based Su-30MKIs and MiG-29Ks, carrier-based MiG-29Ks require three types of air-to-ground PGMs: lightweight 700km-range LACMs, 300km-range cruise missiles containing runway-cratering sub-munitions, and 500lb LGBs. Concurrently, the IN’s future principal warfare combatants (like DDGs) that are still on the drawing boards do need to be equipped with silos containing no less than 24 vertically-launched, 1,200km-range LACMs armed with conventional warheads.

Lastly, initiate without any further delay the development of a 5,000-tonne SSGN that can operate as both a self-seeking hunter-killer as well as a submerged launcher (from its torpedo-tubes) of no less than eight 1,200km-range LACMs armed with conventional warheads. While AIP-equipped Scorpene SSKs are up to the task of providing ASW screens around vital naval and economic coastal installations, when it comes to cruising submerged at high speeds while escorting CBGs or even when operating alone inside hostile waters, the SSGN has no equal.